Find future value of annuity

You may combine cash value life insurance with term insurance for the period of your greatest need for life insurance to. R Discount or interest rate.

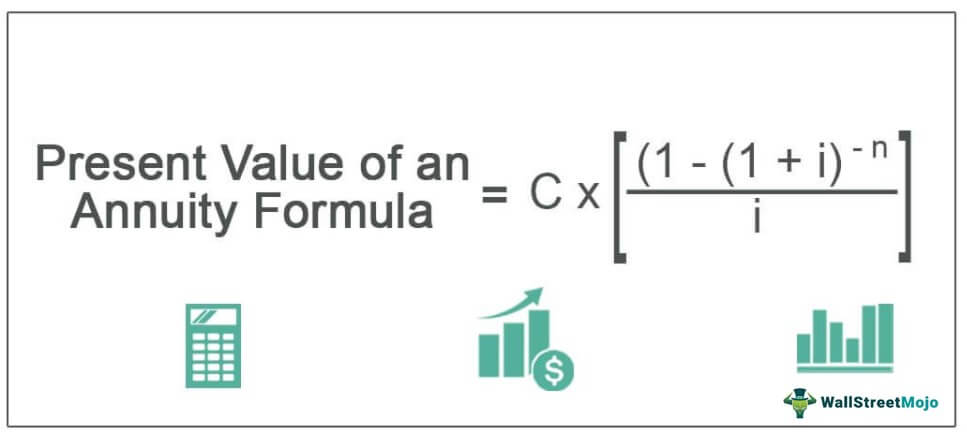

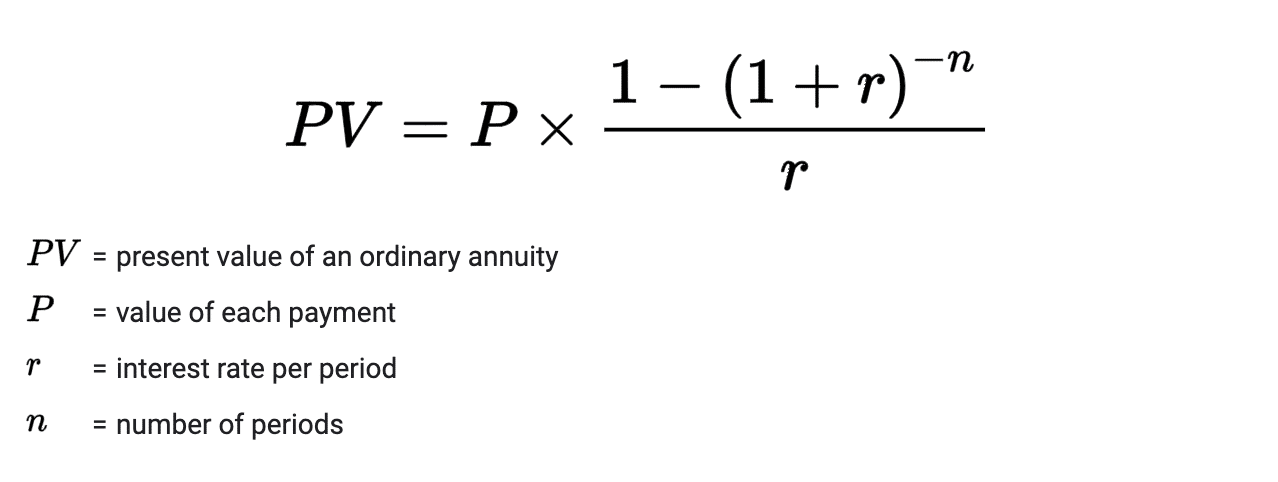

Present Value Of Annuity Formula Calculate Pv Of An Annuity

The higher the Rate of a deal the higher the future price.

. The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Advantages of Net present value method Time value of money.

The value in an annuity contract is the amount in premiums you have paid minus any applicable charges plus any interest your premiums have earned. The basic annuity formula in Excel for present value is PVRATENPERPMT. The future value of the annuity is shown in the letter F.

The time value of money TVM is the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. Valuation is the calculation of economic value or worth. The present value is given in actuarial notation by.

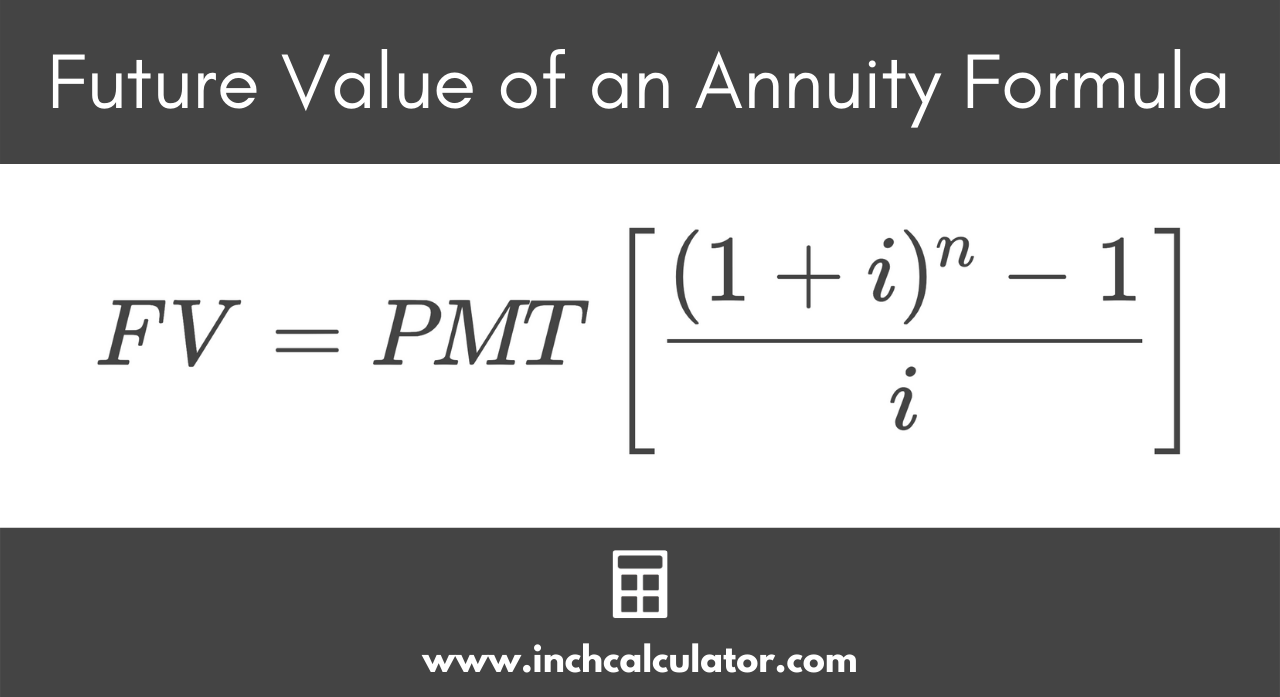

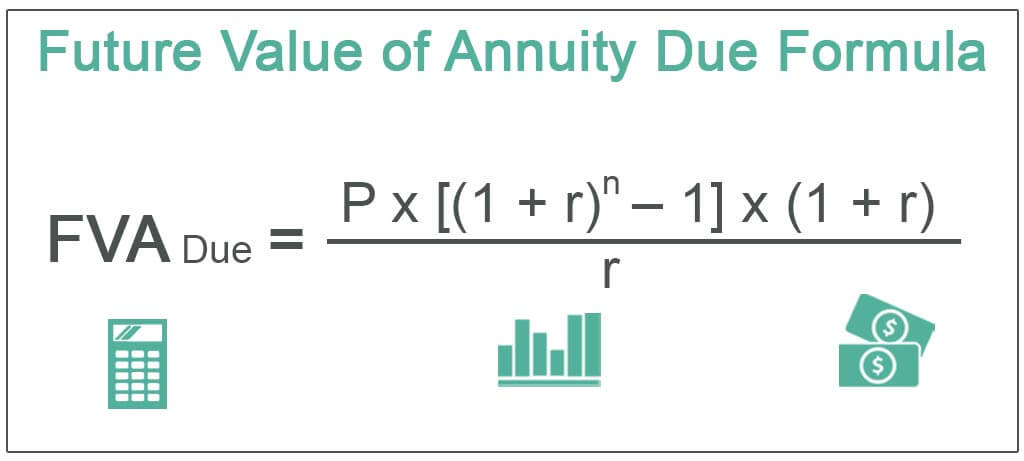

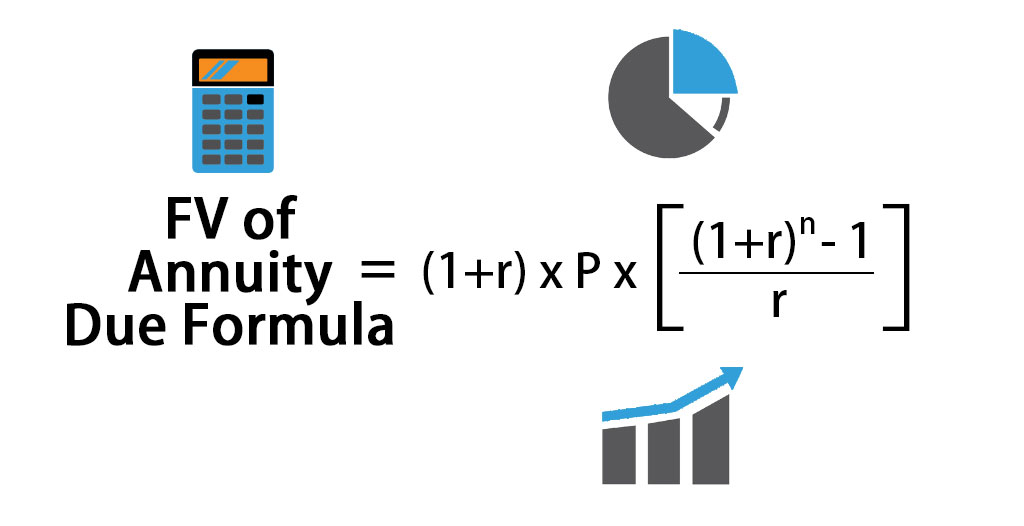

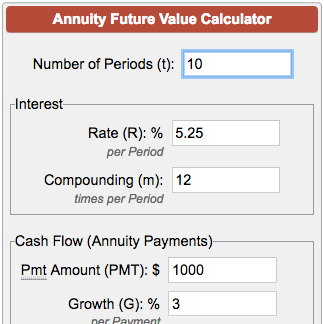

The future value of an ordinary annuity which is a regular payment made on an asset such as property or received from an investment such as interest. Spreadsheet software and online calculators can also help you make these future valuerelated calculations. Assume that in the example above the annuity payment is to be received at the beginning of each year.

An annuity is a sum of money paid periodically at regular intervals. The algorithm behind this future value of annuity calculator applies the equations detailed here. The value of an annuity contract or a life insurance policy issued by a company regularly engaged in the sale of such contracts or policies is the amount that company would charge for a comparable contract.

Annuity Due Payment - Future Value FV Calculator. Figuring Out the Future Value of an Annuity. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where.

Future Value - FV. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. N Number of periods in which payments will be made.

How to find the best high-yield savings accounts 3 types of savings accounts you could open for your child Retirement savings by age. H Historic building Building in registered historic district. Present Value Of An Annuity.

Future Value FV Present value 1 rNP Compound interest factor C 1 BVP Where. Calculating the Future Value of an Ordinary Annuity. Excel can perform complex calculations and has several formulas for just about any role within finance and banking including unique annuity calculations that use present and future value of annuity formulas.

While you may feel inclined to trust growth projections in the annuity sales materials your advisor initially showed you sales. Annuity Payment - Future Value FV Calculator. Present value is linear in the amount of payments therefore the present.

In other words the purchasing power of your money decreases in the future. Present value of an ordinary annuity table. This formula relies on the concept of time value of money.

Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest. You can find derivations of future value formulas with our future value calculator. Excel can be an extremely useful tool for these calculations.

FV due Future value of annuity due. The payment number is N the shows N as an exponent. But does not build up cash values that you can use in the future.

PV due Present value of annuity due. I am equal to the interest rate discount. Find the present value of due annuity with periodic payments of 2000 for a period of 10 years at an interest rate of 6 discounted semiannually by factor formula and table.

Net present value or the difference between cash inflow and outflow over the course of an investment. By looking at a present value annuity factor. 2000 PVIFA 62 102 Answer.

And hence the further the cash flows lesser will the value. Future Value of an Annuity FVdfracPMTi1in-11iT where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the compounding frequency per period t. Net present value method is a tool for analyzing profitability of a particular project.

The present and future values of an annuity due can be computed as follows. This present value of annuity calculator estimates the value in todays money of a series of future payments of the same amount for a number of periods the interest is compounded due or ordinary. Future value of an ordinary annuity the formula F P 1 IN 1I is calculated in which case P is the payout amount.

The future value FV is the value of a current asset at a specified date in the future based on an assumed rate of growth over time. Valuation of an annuity is calculated as the actuarial present value of the annuity which is dependent on the probability of the annuitant living to each future payment period as well as the interest rate and timing of future payments. Determining Fair Market Value Future events effect on value Future Events.

Future Value Annuity Formulas. It takes into consideration the time value of money. The future cash flows of.

Trying to estimate the future value of an annuity can feel overwhelming. Present Value of Annuity PV is estimated by taking account of the annuity type - If ordinary then the formula is. PMT Dollar amount of each payment.

The cash flows in the future will be of lesser value than the cash flows of today. Future Value Annuity Formula Derivation. Time value of money is the concept that a dollar received at a future date is worth less than if the same amount is received today.

Annuities are complex products so figuring out how much yours will be worth may take some work. Where is the number of terms and is the per period interest rate. The present value annuity factor is used to calculate the present value of future one dollar cash flows.

PV due PV ord 1 r PV due. Annuity Due Payment - Present Value PV Calculator. This is also called discounting.

Then the present value of the annuity will be. Life tables provide the probabilities of survival necessary for such calculations. P Present value of your annuity stream.

Time Value of Money - TVM. RP Regular payment. Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula.

It may be seen as an implication of the later-developed concept of time preference. PVOA APr 1 - 11 rN - If due then the formula is. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing.

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Future Value Of An Annuity Formula Example And Excel Template

How To Calculate The Present Value Of An Annuity Youtube

Future Value Of An Annuity Calculator Inch Calculator

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Ordinary Annuity Calculator Future Value Nerd Counter

Annuity Formula What Is Annuity Formula Examples

Excel Formula Future Value Of Annuity Exceljet

Excel Formula Future Value Of Annuity Exceljet

Annuities How To Calculate The Future Value Of An Annuity Due Youtube

Future Value Of Annuity Due Formula Calculation With Examples

Future Value Of Annuity Due Formula Calculator Excel Template

Future Value Of Annuity Formula With Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

How To Measure Your Annuity Due

Present Value Of An Annuity How To Calculate Examples

Future Value Of Annuity Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities